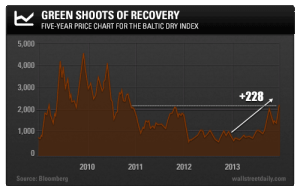

China’s imports rose the most in five months in December, indicating that domestic demand will support economic growth, as the government claimed the title of the world’s biggest trader of goods.

Inbound shipments advanced 8.3 percent from a year earlier, the customs administration said today in Beijing. Exports rose 4.3 percent, a pace that may be distorted by fake invoices. The trade surplus was $25.6 billion.

Improving demand will help support expansion amid risks from rising domestic debt and the impact of President Xi Jinping’s broadest policy reforms since the 1990s. While China said today it passed the U.S. to become the top trading nation in 2013, the government highlighted challenges for exporters including gains in the yuan and increased labor costs.

China already ranked No. 1 in goods exports in 2012 and was the second-biggest importer behind the U.S., according to the World Trade Organization’s annual report on international trade statistics. With $2.08 trillion in inbound shipments through November, the U.S. was poised to remain the world’s biggest importer in 2013.

China was fifth in exports of commercial services in 2012, behind the U.S., U.K., Germany andFrance, the WTO said. China was No. 3 in imports of services, behind the U.S. and Germany.

In economic size, China remains second to the U.S., with gross domestic product of about $8.2 trillion last year, about half that of the U.S.

The yuan rose 2.9 percent against the dollar last year, the most of 11 Asian currencies tracked by Bloomberg. It touched 6.050 earlier today, matching the level reached on Jan. 2, which was the strongest since the government unified the market and official exchange rates at the end of 1993.

The economy may have expanded 7.6 percent in 2013, according to a State Council report last month, the weakest pace in 14 years. Growth will slow to 7.4 percent in 2014, based on the median estimate of 48 economists surveyed by Bloomberg News last month, which would be the lowest since 1990.

(Source: Bloomberg)