After struggling in recent years, international equity markets have been performing well so far this year. Year to date, as of September 29th, developed equity markets, as measured by the MSCI EAFE Index, gained nearly 3%, despite all the problems ranging from negative interest rates to Brexit. Emerging markets equities, as measured by the MSCI Emerging Market Index, did even better, jumping nearly 18%, far exceeding the 7% gain of the S&P 500 Index. However, international equities are facing a huge test: the upcoming US presidential election. Although these markets deal with this every four years, the stakes are even higher this year due to the unique characteristics of the two candidates.

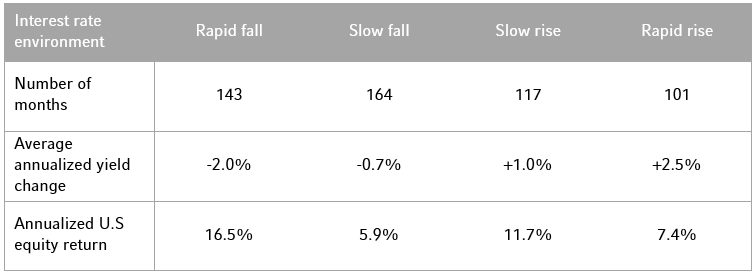

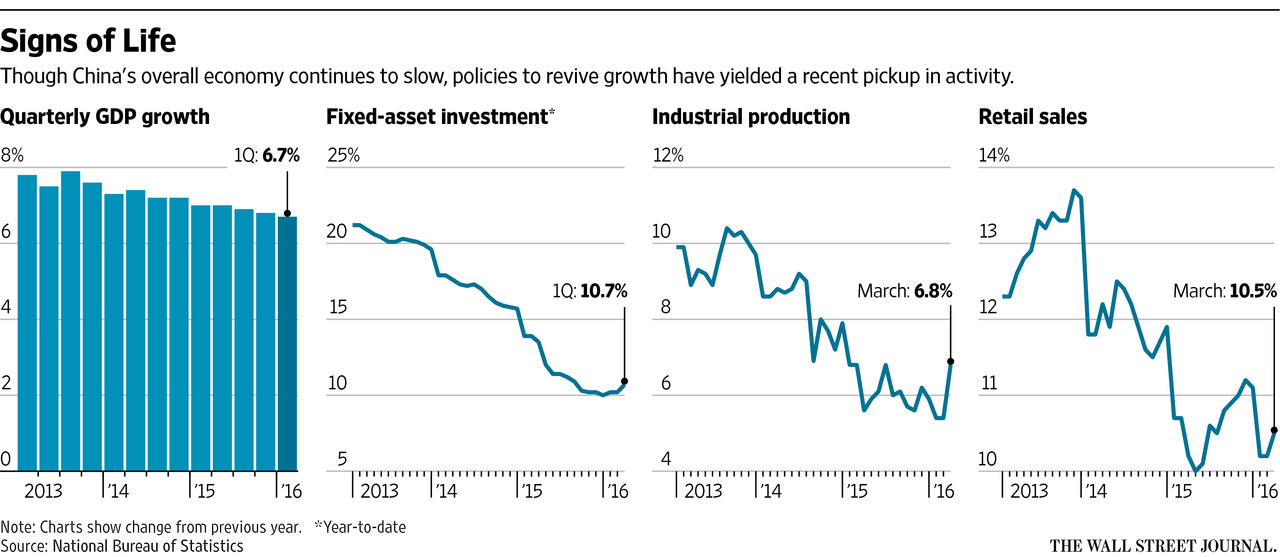

Mr. Trump, the Republican Party nominee, has almost made this US election all about unfair international trade—unfair trade has caused job loss in the US, unfair trade has caused huge national debt, and unfair trade has made the US not so great. Apparently, if Mr. Trump wins, and follows through with his anti-trade election rhetoric, international equity markets will be affected, as a number of countries still rely heavily on exports to the US to grow their economies. However, potentially more damaging and less dramatized by the media is his anti-Federal Reserve (Fed) rhetoric, and he truly may mean it. Mr. Trump shares a quite popular view among many that the Fed is too political, keeps interest rates too low for too long, and is creating a huge asset bubble that is bound to burst. If he becomes the next president, and rushes to reverse Fed policy in his “Trump” style, interest rates could potentially jump and the dollar could surge. Whereas the sudden change and chaos may affect financial markets worldwide, emerging markets are likely to be hit the hardest. Currency values of many emerging markets countries are somewhat pegged to the US dollar, and some of them use the US dollar as their currency outright, without bothering to issue their own currency. As a result, their monetary policies are highly dictated by the Fed, and for some, the Fed is essentially their central bank as well. A sudden rise in both US interest rates and the dollar means monetary policies can tighten quickly, a shock that few emerging markets economies, (which tend to have relatively fragile financial systems), can handle.

Ms. Clinton, the Democratic Party nominee, is a status-quo candidate, and the status-quo, while not ideal for all stakeholders of the economy, has been great for most investors in recent years. As the former First Lady, US Senator, and Secretary of State, Ms. Clinton may have greater insight into the international situation, and she is also a more familiar figure to leaders of other countries. From this familiarity perspective alone, Ms. Clinton may be less of a risk than Mr. Trump for international equity markets. The TPP (Trans-Pacific Partnership) is so far about the only thing in which Ms. Clinton differs from President Obama, as she has switched from supporting to opposing TPP when her presidential campaign started. She may very well switch back if and when she becomes president. TPP is not really a giveaway from the US to other countries, and so far only 12 countries are included in the deal (China is not even part of it). There should be limited damage to the international equity markets if TPP is revoked.