KKR today released the 2018 Global Macro Outlook piece by Henry McVey, Head of Global Macro and Asset Allocation (GMAA). In “You Can Get What You Need,” McVey outlines his perspective on the current investing environment.

“As we are poised to enter the 104th month of economic expansion amidst the second longest bull market on record in the United States, it is definitely harder to get ‘what you want’ when it comes to uncovering new and compelling investment opportunities. The good news is that our work shows that investors can still ‘get what they need’ in order to generate returns in excess of their liabilities.”

Overall, a major underpinning to Henry McVey and the GMAA team’s view for 2018 is that overly optimistic investors are currently overpaying for growth and simplicity in many instances, while at the same time ignoring stories with complexity, uncertainty, and/or cyclicality. Therein lies a huge, long-tailed investment opportunity to arbitrage the notable bifurcation that has already begun to occur across many parts of the global markets, according to the team.

Against this backdrop, the report outlines several actionable investment themes that multi-asset class investors should consider weaving into their portfolios in 2018 and beyond, including:

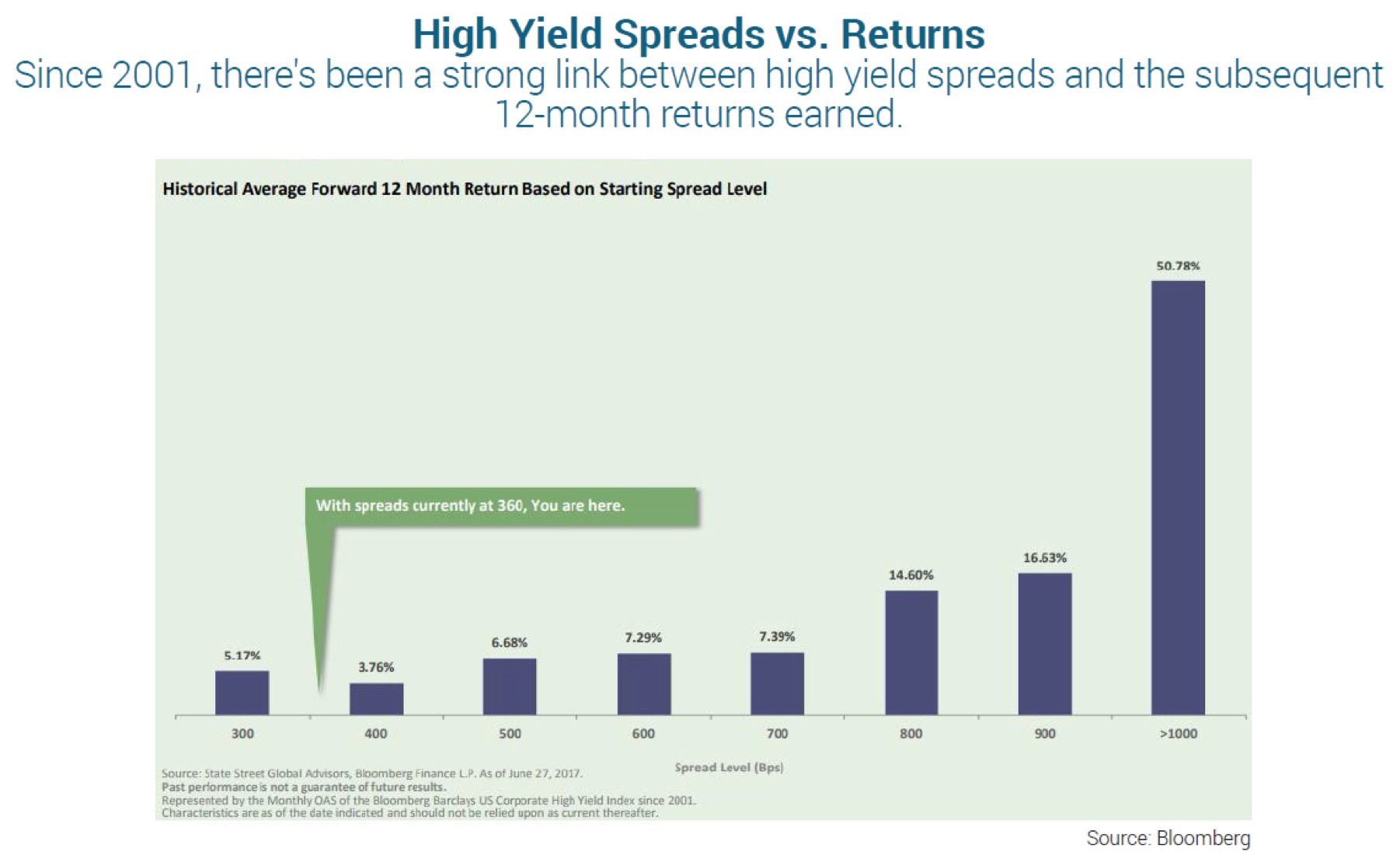

1. Equities Having More Potential Upside Than Credit

2. The Move Towards Mid-Cycle Phase of Emerging Markets Recovery

3. Central Bank Normalization

4. Shifting Preferences in Private Credit

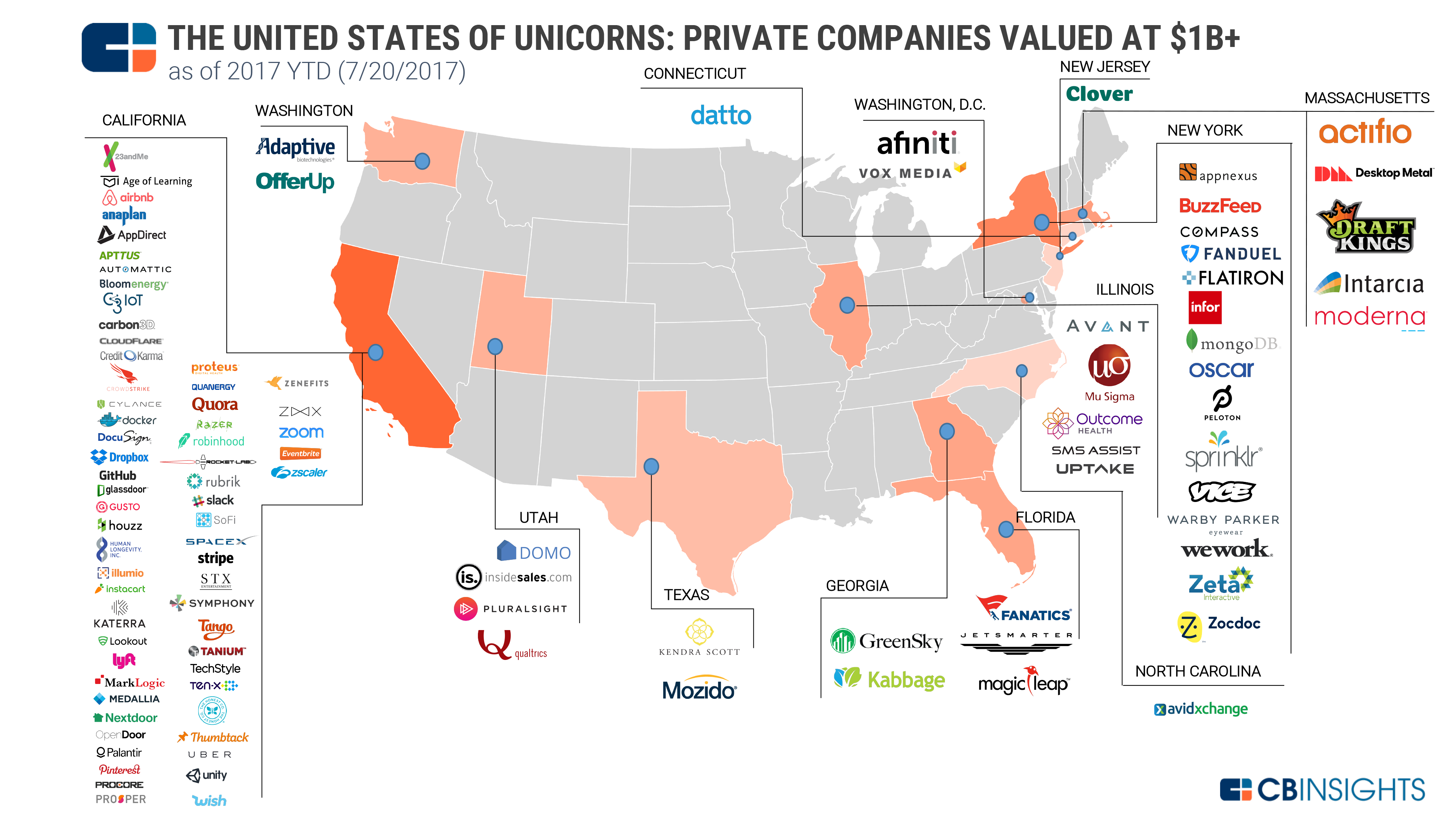

5. Buy Complexity, Sell Simplicity

6. Experiences Over Things

7. Arrival of a Different Kind of ‘Political Bull Market’

In addition to the aforementioned themes, the report details specific macro influences that factor into the GMAA team’s updated asset allocation model for 2018, including GDP targets around the globe as well as outlook for earnings, rates, oil, cycle duration and expected returns.