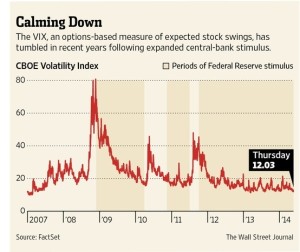

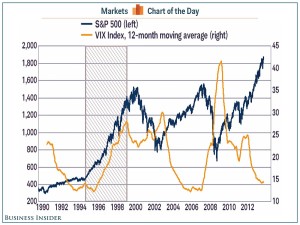

In the absence of any significant news, and with the Ukrainian situation easing somewhat, market volatility, as measured by the VIX has fallen to a 14 month low. Today VIX is trading just 0.65 above the March 14, 2013 low of 11.05, which was the low reached in this bull market. Many believe that a low VIX, which is sometimes called the “fear index,” indicates investor complacency, suggesting that the market is near its peak. Indeed the VIX hit a low of 9.36 in December 2006, 10 months before the peak of the stock market and the beginning of the greatest bear market in 75 years.

But the ability of the VIX to predict bear markets is spotty at best. The lowest level the VIX has ever reached since it was first computed in the mid 1980s, was 8.89 in December 1993. Although the onset of 1994 was rough because of the unexpected rate increase put in by Fed Chief Alan Greenspan, the secular bull market was still well intact. Another intermediate low for the VIX of 10.00 was reached on March 1995,

but that also did not mark a market peak. In fact the VIX continued to rise in the last five years of the great 1982-2000 bull market which peaked on March 2000.

The Chicago Board Options Exchange Volatility Index, or VIX, is widely considered to be stocks’ “fear gauge.” When things get wild, usually the VIX will increase in value. A portion of the investment community points to this as us being “lulled to sleep by complacency,” and the law of averages will bring us back to more volatile times. However, they may also have simply grown too accustomed to what could turn out to be a brief period in history when volatility was abnormally high. Whatever the case, the S&P 500 has traded in a tight range of only 4.5 percent since March 4, according to the Wall Street Journal. This calmness among stocks has been eerie to some, and surprising to almost everyone.

Is this the calm before the storm? Is Sell-In-May-And-Go-Away going to cause the VIX to go higher?

(Source: WSJ, etc.)