Robert L. Riedl, CPA, CFP®, AWMA®

Director of Wealth Management

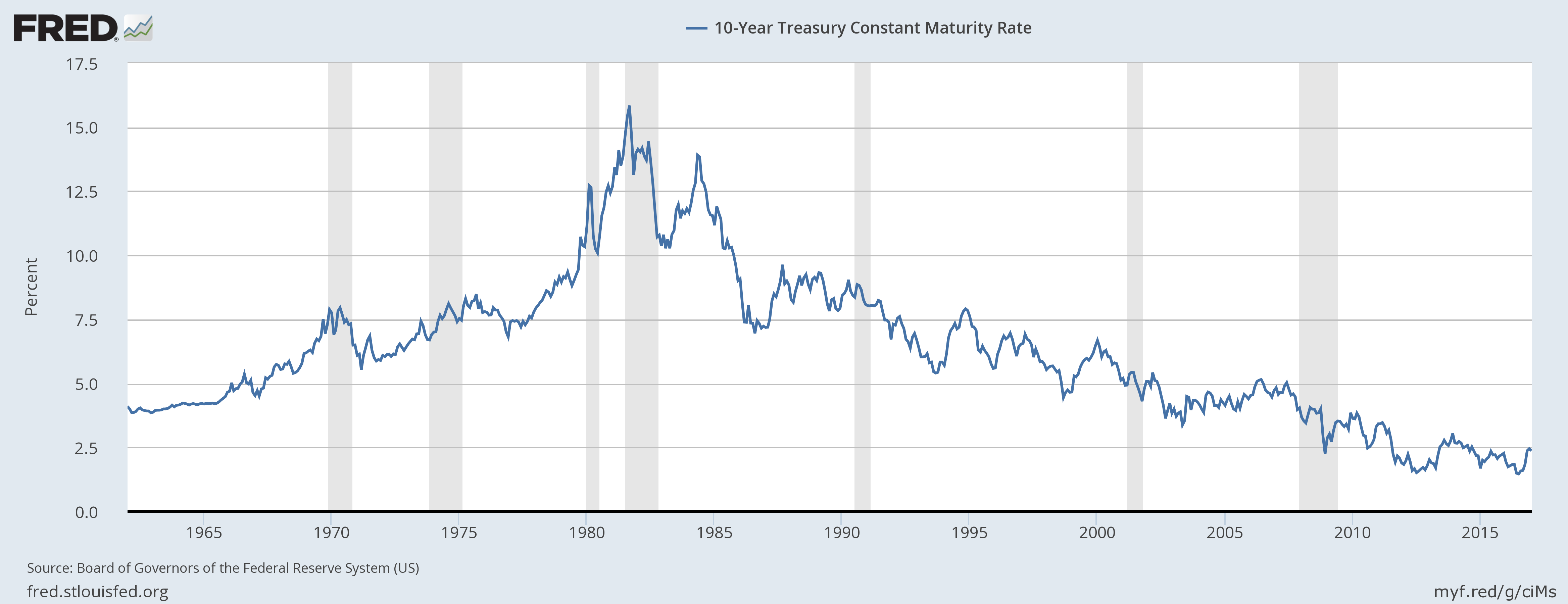

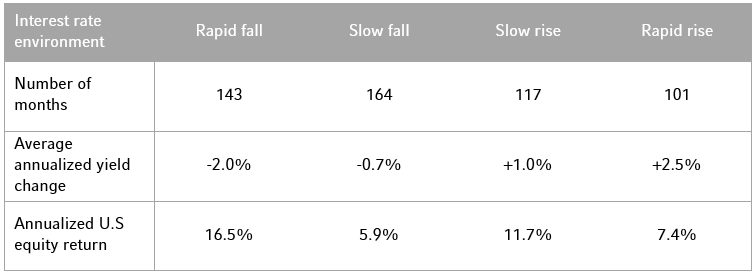

For the past 30 years, the extended period of falling interest rates made long-term US Treasury bonds a great place to be. However, late last year, indications surfaced that the long-term decline in interest rates may be reversing. Yields on 10-year US Treasury bonds hit a low of 1.32% on July 6, 2016 and are now at 2.38% (which is still below the historic average rate of over 4%).

For savers that have been earning about 0.2% interest on cash for the last few years, the prospect of rising interest rates is a welcome relief. However, for investors in bonds, including traditional US Treasury bonds (which have historically been considered conservative investments), rising interest rates should be an alarming situation.

Fact: For every one percentage increase in interest rates, 10-year US Treasury bonds will fall approximately 8.8% and 20-year US Treasury bonds will fall 17.5%! In comparison, the Barclay Aggregate Bond fund will only fall 5.8% because of its broader diversification and lower duration. Thus, understand the duration or maturity of your bond holdings to properly assess the interest rate risk of your portfolio.

It is possible to mitigate interest rate risk. For example, substitute your long-term bonds for a stable value fund. There are fixed income alternatives (which we call satellite investments), to consider that may diversify your fixed income portfolio, such as floating rate debt, high yield bonds, emerging market bonds, inflation-linked bonds, or possibly private credit strategies such as mezzanine debt, middle market debt, venture debt, peer to peer debt, structured credit, or others.

Interest rate risk is not the only risk affecting bonds. Numerous other factors influence your fixed income allocation, such as credit risk, your personal risk tolerance, and others. Let us help you understand your fixed income portfolio. To arrange for your complimentary, no-obligation consultation to review your fixed income portfolio with a fee-based fiduciary adviser at Endowment Wealth Management, contact us today.

Disclaimer: Not intended as individualized investment advice. All investments involve risk. Investments not insured, not bank guaranteed and may fluctuate in value. Diversification does not protect against loss in a declining market. You should consider your goals, risk tolerance, and the risks and costs of investing before making any investment decision.