The 10 points “represent a broad list of macro themes from our economic outlook that we think will dominate markets in 2014.”

Here they are, with the key quotes pulled from the note.

1. Showtime for the US/DM Recovery

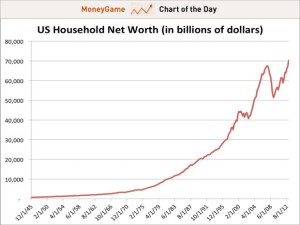

Our 2013 outlook was dominated by the notion that underlying private- sector healing in the US was being masked by significant fiscal drag. As we move into 2014 and that drag eases, we expect the long-awaited shift towards above-trend growth in the US finally to occur, spurred by an acceleration in private consumption and business investment.

2. Forward guidance harder in an above-trend world

Despite the improvement in growth, we expect G4 central banks to continue to signal that rates are set to remain on hold near the zero bound for a prolonged period, faced with low inflation and high unemployment. In the US, our forecast is still for no hikes until 2016 and we expect the commitment to low rates to be reinforced in the next few months.

3. Earn the DM equity risk premium, hedge the risk

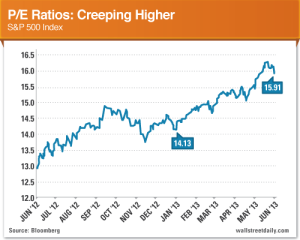

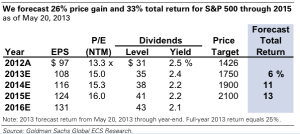

Over the past few years, we have seen very large risk premium compression across a wide range of areas. While not at 2007 levels, credit spreads have narrowed to below long-term averages and asset market volatility has fallen. Even in a friendly growth and policy environment such as the one we anticipate, this is likely to make for lower return prospects (although more appealing in a volatility-adjusted sense). In equities, in particular, the key question we confront is whether a rally can continue given above-average multiples. We think it can.

4. Good carry, bad carry

Our 2014 forecast of improving but still slightly below-trend global growth and anchored inflation describes an environment in which overall volatility may justifiably be lower. Markets have already moved a long way in this direction, but equity volatility has certainly been lower in prior cycles and forward pricing of volatility is still firmly higher than spot levels. In an environment of subdued macro volatility, the desire to earn carry is likely to remain strong, particularly if it remains hard to envisage significant upside to the growth picture.

5. The race to the exit kicks off

2013 has already seen some EM central banks move to policy tightening. As the US growth picture improves – and the pressure on global rates builds – the focus on who may tighten monetary policy is likely to increase. As we described recently (Global Economics Weekly 13/33), the market is pricing a relatively synchronised exit among the major developed markets, even though their recovery profiles look different. Given that the timing of the first hike has commonly been judged to be some way off, this lack of differentiation is not particularly unusual. But the separation of those who are likely to move early and those who may move later is likely to begin in earnest in 2014.

6. Decision time for the ‘high-flyers’

A number of smaller open economies have imported easy monetary policy from the US and Europe in recent years, in part to offset currency strength and in part to compensate for a weaker external environment. In a number of these places (Norway, Switzerland, Israel, Canada and, to a lesser extent, New Zealand and Sweden), house prices have appreciated and/or credit growth has picked up. Central banks have generally tolerated those signs of emerging pressure given the external growth risks and the desire to avoid currency strength through a tighter policy stance. As the developed market growth picture improves, some of these ‘high flyers’ may reassess the balance of risks on this front.

7. Still not your older brother’s EM…

2013 has proved to be a tough year for EM assets. 2014 is unlikely to see the same level of broad-based pressure. The combination of a sharp downgrade to expectations of China growth and risk alongside the worries about a hawkish Fed during the summer ‘taper tantrum’ are unlikely to be repeated with the same level of intensity.

8. …but EM differentiation to continue

2013 saw countries with high current account deficits, high inflation, weak institutions and limited DM exposure punished much more heavily than the ‘DMs of EMs’, which had stronger current accounts and institutions, underheated economies and greater DM exposure. This is still likely to be the primary axis of differentiation in coming months, but in 2014 we would also expect to see greater differentiation within both these categories.

9. Commodity downside risks grow

Last year we pointed to the ongoing shift in our commodity views, ultimately towards downside price risk. The impact of supply responses to the period of extraordinary price pressure continues to flow through the system. And we are forecasting significant declines (15%+) through 2014 in gold, copper, iron ore and soybeans. Energy prices clearly matter most for the global outlook. Here our views are more stable, although downside risk is growing over time and production losses out of Libya/Iran and other geopolitical risk is now playing a large role in keeping prices high.

10. Stable China may be good enough

Expectations of Chinese growth have reset meaningfully lower as some of the medium-term problems around credit growth, shadow financing and local governance have been widely recognised over the past year. Some of these issues continue to linger: the risks from the credit overhang remain and policymakers are unlikely to be comfortable allowing growth to accelerate much. But the deep deceleration of mid-2013 has reversed and even our forecast of essentially flat growth (of about 7.5%) may be enough to comfort investors relative to their worst fears.